Improving Nature’s Visibility in Financial Accounting - CARE & ecosystem-centred accounting (Method 3) – Extended Version

Thursday 30 April 2020

Improving Nature’s Visibility in Financial Accounting :

> Read the extended version of Method 3 (Method CARE – Comprehensive Accounting in Respect of Ecology - & ecosystem-centred accounting)

> Read the report

> Read the report

« Accountancy as an institution must evolve continuously as new questions are asked of it : the fact that a broader gamut of issues must be taken into account by businesses reveals that the existing accounting framework needs to adapt. This report – Improving Nature’s Visibility in Financial Accounting – offers the potential first steps to change the trajectory of sustainability reporting’s evolution and build an accounting system fit for purpose ».

In "Improving Nature’s Visibility in Financial Accounting" Natural Capital Coalition’s report

This report has been prepared by a project team led by Economics for the Environment

Consultancy Ltd (eftec) on behalf of the Capitals Coalition. This work was generally supported by funding from the Mava Foundation.

Credit: Improving nature’s visibility in financial accounting full report, Natural Capital Coalition, April 2020.

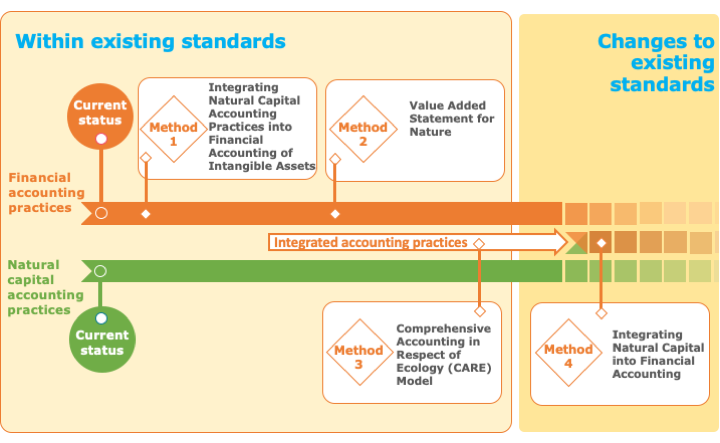

CARE - method 3 - is the only model that is integrative and suitable for standardization.

Extended version of the Method 3 (CARE)

Authors:

Alexandre Rambaud (AgroParisTech, CIRED, Université Paris Dauphine)

Clément Feger (AgroParisTech, Université de Montpellier)

Reviewers: Ian Dickie, eftec

Overview : Schematically, the CARE (Comprehensive Accounting in Respect of Ecology) model is based on:

• an inclusion of social and environmental issues in the balance sheet and income statement;

• an extension of financial solvency to “environmental” and “social solvency”;

• an extension of the principles of protection of financial capital to natural and social capitals.

In this context, social and environmental issues:

• are addressed through the conservation (maintenance) of “capital” “entities” to be preserved (climate,

biodiversity, soils, human beings employed, etc.). Each of the entities is a specific (natural or social) “capital” (a

“capital” entity to be preserved);

• reflected in the balance sheet and income statement by the recognition of social and environmental liabilities

(debts).

As a consequence, natural and social capitals, conceived as liabilities, are valued at their preservation costs (prevention or restoration – not compensation – costs). Assets are uses of (financial, natural and social) capitals. The income is the surplus of revenues after all the capitals have been maintained (preserved).

CARE is therefore a (direct) extension of Historical Cost Accounting and its principles.

To be fully operational, CARE ultimately needs to be articulated with an “ecosystem-centred accounting” model, that accounts for the ecological performances reached at the level of the collective management of a given natural capital entity.

Most of the results of the on-going experiments of CARE cannot be reported to respect confidentiality. In this report, we will simply draw from these real cases to provide schematic examples.

• Case 1: Real estate company (global real estate operator of a French multinational) / experiment on one site / Location: France / real data completed by scenarios (for budgets)

• Case 2: Farm / experiment on one site / Location: France / real data completed by scenarios (for budgets)

• Case 3: Creche (Childcare) / Experiment on one site / Location: France / real data completed by scenarios (for

budgets)

• General results based also on some examples from a series of current experiments in south of France (named

“Collective Operation”), in different sectors - industrial, distribution, etc. - and ranging from SMEs to multinationals (see part 2).

Read the full extended version // Read the full report

Back